File talk:Employment growth by top tax rate.jpg

Usage on the English Wikipedia

I removed this image from a number of articles. Given that it was created and originally added to the articles by Cupco (talk · contribs), who was subsequently banned for being the sockpuppet of a user that was banned for tendentious editing, I didn't think its removal would be controversial. But it was reverted, and a discussion started here.

While posting a newly-created graph showing the correlation between two different variables is not disallowed, it does imply there's a relationship between them. Even more so when the caption includes the comment "Employment has grown with higher top marginal tax rates." In the case of these two variables, it might indeed be that a higher top income tax bracket causes the employment rate to grow. It might also be that high rates of employment growth causes the government to raise taxes on high earners. It could also be that both could be attributed to a common third cause, such as a demographic dividend, the post–World War II economic expansion, or something else entirely. It could also be that the two are totally unrelated, and the appearance of a link is due to the comparatively low number of datapoints. Either way, it would be novel synthesis for us to draw (or imply) any conclusion as to which of these is the proper interpretation of the data. Any such conclusions (whether explicit or implicit) must be thoroughly sourced to reliable sources.

While not strictly prohibited by any policy or guideline, it is highly inappropriate to include such a graph without a properly sourced commentary in either the caption or article text discussing what conclusions we might (or ought) to draw from it. The articles I removed the graph from were lacking in this regard. Some of them were discussing the consequences of taxes on employment (as mentioned here), but were referring to the corporate tax rate, instead the effective top rate of income tax that this graph uses.

For example, the graph given in Flying Spaghetti Monster#Pirates and global warming certainly has a place on Wikipedia, but it would be disingenuous to include it in our articles on pirates or global warming without discussing how they are related. That's what I meant by correlation does not imply causation. Gabbe (talk) 09:53, 6 November 2012 (UTC)

- I'm trying to understand what's going on with which refers to a report with a different graph but with a title and serveral sections which supports the disputed historical implication explicitly. Given and I think this discussion should continue at Talk:Economics#Unemployment and effective tax rate. Paum89 (talk) 10:09, 6 November 2012 (UTC)

That lower top marginal tax rates do not lead to increased employment but rather the opposite is backed up by solid statistical data. Here is an article in the New York Times by economists at UC Berkeley who have analysed state and national employment data stating this conclusion: http://economix.blogs.nytimes.com/2012/10/19/tax-cuts-for-job-creators/. The implied conclusion of the graph is based on solid analysis and the statement that "correlation does not imply causation" can be easily thrown around in the social sciences to shut down any conclusion. It is not clear to me that any result in economics cannot be nullified with the possibility that "correlation does not imply causation". Guest2625 (talk) 12:54, 6 November 2012 (UTC)

- This and this say there is no evidence to prove that lowering the highest rate of income tax causes employment to rise. From what I can tell, they don't claim that there's evidence of the opposite (namely that raising the highest rate of income tax causes employment to rise). In fact, they say again and again that there's "no link between income tax cuts for the top 5 percent and subsequent job creation". In other words, they say that there's no relation between the two things constituting the axes in this graph. Gabbe (talk) 14:00, 6 November 2012 (UTC)

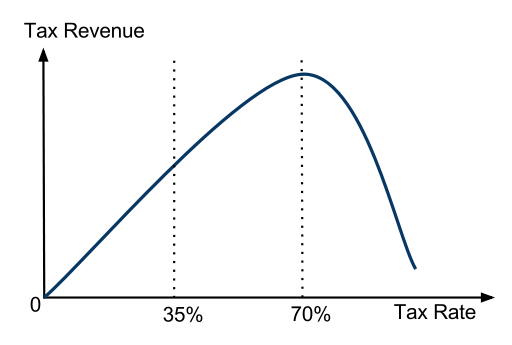

I find the graphic extremely misleading. It suggests an optimal tax rate of above 75% for economic growth. The higher the tax rate, the more the economy grows? That's just completely stupid and defies all logic and empirical evidence. How can you take money out of the economy and thus boost it? Whatever metric they're using, it's not complete. Morphh (talk) 14:15, 6 November 2012 (UTC)

- The graph also appears at Talk:Laffer curve#33.25 peak where you were discussing serious economists saying the optimum is at 84%. I've seen people say anywhere from 5% to 85% is accurate. With that kind of diversity of opinion, shouldn't we only be presenting historical summaries? Paum89 (talk) 17:35, 6 November 2012 (UTC)

- The graph does not appear to show the optimal for laffer curve, which is the top tax rate before you receive less revenue. That might actually make sense and if that's the case then the graph is labeled extremely poorly. It seems to suggest the optimal rate for economic growth. Two very different things. Morphh (talk) 03:13, 7 November 2012 (UTC)

Although, it is convenient to have a centrally located discussion about this graph. I don't think the discussion can be centralised, since inclusion or exclusion of the graph is article dependent. The discussion on this talk page should be limited to whether the data being displayed is false. This is not the case. The graph is not stating anything but merely displaying in graphical form historical data. Now what the caption says and whether the graph is included in an article should be kept to the specific article talk pages. Guest2625 (talk) 00:29, 7 November 2012 (UTC)

- I don't think anyone is arguing that the underlying data is erroneous. My argument (for which I was trying to establish a consensus here, as it is basically the same in all articles that includes this graph) is as follows. Just like with this graph (which is also based on accurate data), the juxtaposition of these two datasets needs to be sourced and their supposed connection needs to be discussed in articles that include this graph. Placing this image in an article without discussing its contents can be misleading. Gabbe (talk) 08:03, 7 November 2012 (UTC)

- This graph is not nearly the same as the 'pirates versus global warming" which everyone can agree is an absurd graph. To plot employment growth versus top marginal tax rate is not an absurd proposition. In fact comparing these two datasets is a completely reasonable thing to do. This is why I gave a link to the NYT article which was similarly addressing the issue of job growth versus tax rates/changes . The academics in that article thought that looking at such comparison data was completely rational. The difference between their graphs and this one is that they looked at changes of tax rates versus employment growth, while this graph displays simply tax rates versus employment growth. The statement that "in the years that there were higher top marginal tax rates there was also higher employment growth" is a completely rational statement to make about the historical data. Now if you want to include the disclaimer that "this does not necessarily mean that higher top marginal tax rates leads to higher employment growth" that's also a reasonable statement to make.

- The data from the NYT article and this graph appear to show that at a minimum higher top marginal tax rates do not lead to less employment growth (something that is taken as a given by the media and public but lacks any factual basis), and in fact the data appears to show the opposite that higher taxes on top marginal rates lead to slightly more employment growth. I find this data very interesting and as a reader of wikipedia do not feel that this information should be hidden from me under spurious arguments of correlation and causality. If there needs to be a disclaimer that I as a reader need to be cautious about the conclusions I draw from the data that's fine, but I don't want to be treated as a mathematical illiterate and have this information hidden from me.

- I do however agree that this information has been displayed in too many articles in which the graph only has a tenuous relation with the article's topic, and in this situation each of the talk pages will have to address this issue. Guest2625 (talk) 13:15, 7 November 2012 (UTC)

- Agree with Gabbe. While the data is historically accurate, you can use statistics to show anything and I think it amounts to WP:SYN. For example, employment growth was higher under Clinton than Obama, despite lower taxes under Obama. Does anyone really think the lower taxes caused decreased employment under Obama or that Clinton's higher taxes is the reason for the 90's boom? No, there are so many other factors at work, which can be applied to the entire graph - taxes are just one aspect of an economy. It pushes a point of view using a limited set of data as evidence of causality. It's like a Freakonomics graph. The NYT blog article is an extremely bias opinion piece that contradicts an abundance of global empirical evidence. Since images hold a certain level of WP:POV above text in the context of WP:WEIGHT, it would have to be a really notable and highly held opinion to give it such prominence in an article. I think this falls into the viewpoint of a tiny minority or WP:FRINGE area. I'd have a difficult time including the image in an article unless it was very notable to the topic point or in an article that focused on that specific topic. Even then, I'm not sure what the image would bring as again, it pushes a point of view of correlation and causality that is not supported by the data. That's not to say that the argument could not be made and included given good sources, but the image itself would really need some additional context to present it as something meaningful. Morphh (talk) 13:59, 7 November 2012 (UTC)

- You can not "use statistics to show anything." Above you write that the "graph does not appear to show the optimal for laffer curve, which is the top tax rate before you receive less revenue" -- under what conditions would more employment not result in more revenue? The overall tax rate as a percent of GDP has remained remarkably constant in the US for more than the past century. The data is from the Congressional Research Service, not the NYT blog. Paum89 (talk) 19:13, 8 November 2012 (UTC)

- Obviously I was being facetious with the statistics comment. The point was that the data is inadequate to support the conclusion being pushed in the graph - causality. You just can't take data and plot a correlation - that's WP:SYN. As for the Laffer curve, the image doesn't state anything in that regard. It's not even a curve. What is the hypothesis here? Higher taxes = Jobs? Taxing the economy above 75% creates the most economic growth? Guess the Tax competition needs a rewrite. Morphh (talk) 21:49, 8 November 2012 (UTC)

- Why do you think the graph is pushing causality instead of simply depicting history? Paum89 (talk) 23:44, 8 November 2012 (UTC)

- The graph title says "Employment growth based on the Top Marginal tax rate", which suggests the top marginal tax rate is the cause (employment based on rate). What is the purpose otherwise - we could just as easily put anything on that axis: abortions, pet adoptions, my level of arousal, storms. Larger hurricane storms when the marginal tax rate is low! No prob, just recording history right? If there is no suggestion of causality, it makes no sense. Morphh (talk) 01:03, 9 November 2012 (UTC)

- The date range is in the title. Let's talk about the extent to which there is a causal relationship. Are you familiar with vector autoregression? Paum89 (talk) 16:12, 9 November 2012 (UTC)

- The graph title says "Employment growth based on the Top Marginal tax rate", which suggests the top marginal tax rate is the cause (employment based on rate). What is the purpose otherwise - we could just as easily put anything on that axis: abortions, pet adoptions, my level of arousal, storms. Larger hurricane storms when the marginal tax rate is low! No prob, just recording history right? If there is no suggestion of causality, it makes no sense. Morphh (talk) 01:03, 9 November 2012 (UTC)

- Why do you think the graph is pushing causality instead of simply depicting history? Paum89 (talk) 23:44, 8 November 2012 (UTC)

- Obviously I was being facetious with the statistics comment. The point was that the data is inadequate to support the conclusion being pushed in the graph - causality. You just can't take data and plot a correlation - that's WP:SYN. As for the Laffer curve, the image doesn't state anything in that regard. It's not even a curve. What is the hypothesis here? Higher taxes = Jobs? Taxing the economy above 75% creates the most economic growth? Guess the Tax competition needs a rewrite. Morphh (talk) 21:49, 8 November 2012 (UTC)

- You can not "use statistics to show anything." Above you write that the "graph does not appear to show the optimal for laffer curve, which is the top tax rate before you receive less revenue" -- under what conditions would more employment not result in more revenue? The overall tax rate as a percent of GDP has remained remarkably constant in the US for more than the past century. The data is from the Congressional Research Service, not the NYT blog. Paum89 (talk) 19:13, 8 November 2012 (UTC)

Just wanted to note that Paum89 is apparently a sock of a banned user. Putting that aside this graph has been added to a lot of articles where it is more or less irrelevant. Proceeding to remove these instances. Volunteer Marek 17:56, 12 November 2012 (UTC)

- 17 articles? The graph reflects historical facts and there is plenty of support for it on Talk:Economics. Is there anyone saying it pushes a political point of view who is not biased against it because of their own politics? Vilonermo (talk) 14:44, 14 November 2012 (UTC)

- This graph may not prove that high taxes cause high employment. But anyone making "original research" type arguments saying that idea must be absurd should consider carefully whether taxing the rich might lead them to part with capital that can create labor opportunities, rather than sitting on the assets as mere investments. Most importantly, the graph argues against the widely espoused idea that cutting taxes on the rich must lead to higher employment - it makes it very, very hard to see how that could possibly be true. That said, the original at is messier and more detailed and hence more realistic, and I have to question whether the binning of these categories has been done to imply an overly simplistic curve; I'd prefer the original or, if possible, even something more precisely detailed. Wnt (talk) 17:36, 14 November 2012 (UTC)

unless you know of something which causes employment growth but not tax revenue growth Pltr6 (talk) 21:33, 14 November 2012 (UTC)

unless you know of something which causes employment growth but not tax revenue growth Pltr6 (talk) 21:33, 14 November 2012 (UTC)

OR Synth

Redrawn with round numbers for categories. Data from http://data.bls.gov/timeseries/CES0000000001 and http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=213 is the classic definition of OR and Synth. the creator of the file, a banned user, combined data from two sources to create a distortion of an image under copyright from yet another source. the same data could be used to create a graph showing growth doubled when the rate was 28% compared to 38%. Darkstar1st (talk) 14:06, 20 October 2013 (UTC)

- Just so you're aware and others that may be reading this talk page. Many of the users above (Cupco, Volunteer Marek, Paum89 and Vilonermo) are all sock puppets of Nrcprm2026. Morphh (talk) 23:40, 20 October 2013 (UTC)